Key Features

The only SMC indicator for NinjaTrader which contains ALL the SMC features

Plots BOS / ChoCh

Shows all BOS (break of struct) and Choch (Change of character)

Plots strong & weak swing hi/los

Shows where the strong & weak swing hi/los are

Plots supply/demand zones

Plots supply/demand zones

Plots order blocks

plots the order blocks

Plots fair value gaps

Shows you the fair value gaps

Plots volume profile for BOS

Shows you a custom volume profile for each BOS

Multi timeframe support

Get higher timeframe information on your chart

Bloodhound & Strategy support

Plots for all the delta signals and important metrics

SMC trading

The only SMC indicator for Ninjatrader 8!

Greater chance of success

Follow the big institutional players and follow their moves

Clear setups

Once you studied smart money concepts you will see that your entries become crystal clear.

Great risk/reward ratio

Smart money concepts allow for scalping but also for great swing trading with risk/reward ratios of 1:20 !!

Follow the big money

Never swim against the current again. Always know what the current trend is and where price will be going to

Smart money / market structure indicator

The TDU Market structure / Smart money indicator is the first indicator for NinjaTrader 8 which can display market structure over multiple timeframes in real-time

Our sophisticated trend analysis will tell you if the trend is up and down in each timeframe. It will spot & display BOS (break of structure) when the trend reverses. But not only that, but it will also show you the ChoCH (Change of Character) which often is the first indication that the trend might change or pull back. So you will be the first to know about a potential trend change using our ChoCH markers and will know exactly when the new trend is confirmed using the BOS

Besides the BOS and ChoCH, this indicator will also show you the weak & strong swing hi's and lows and the internal hi & low.

And of course, it draws up the supply/demand zones since that's a major part of the smart money concepts.

But that is not all. One of the unique features of this indicator is the ability to plot market structure from higher timeframes onto the current chart. So you want to see the 4h market structure on a 15min chart? no problem. In fact, if you look at the following screenshot you will see that we get all the market structure from the daily, 4 hours, 15min, and 5min timeframes into 1 chart. Of course, you are free to choose which and how many timeframes you would like to see on the chart.

Notice these little checkboxes in front of each time frame? By simply clicking on them you can hide all the market structure from that time frame. Click it again and the market structure of that timeframe gets displayed again. This way you can have clean uncluttered charts, but the momen

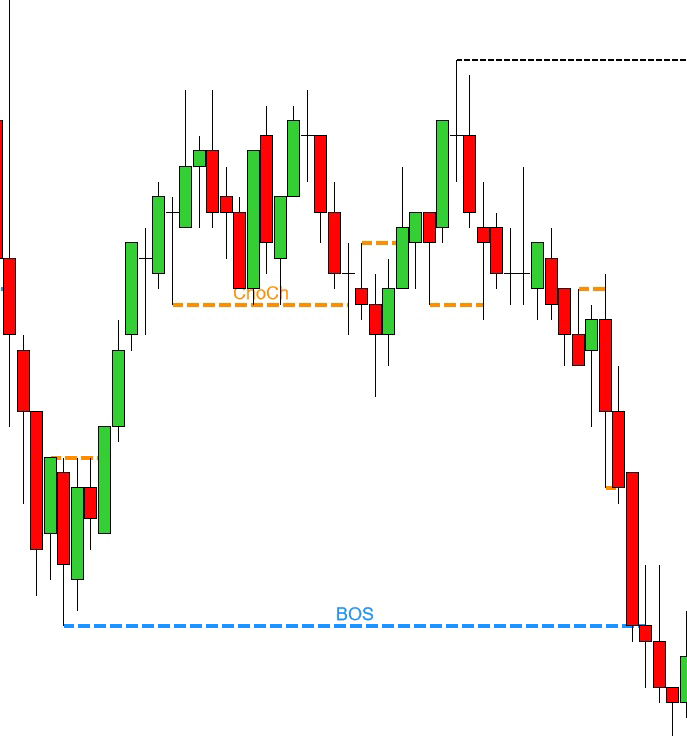

Break of structure (BOS)

The market structure is the big picture, it detects and shows the trend and detects any trend changes. Using a sophisticated algorithm it detects major swing hi's and lows and plots these on your chart. Trend changes, also known as Break of Structure (BOS) are marked on the chart when they occur.

The following screenshot shows both a BOS to the upside, confirming the bullish trend, and later on, a BOS to the downside confirming that now the trend has changed and is bearish

Note that a BOS itself is not a trade entry. It just tells us the direction in which we want to trade. So a BOS to the upside confirms a long trend, which would mean we would only look for long entries. A BOS to the downside confirms a downtrend which means we only look for short entries

Strong and Weak hi/lo's

The indicator shows the last important swing high and low and whether it's a strong or weak one.

- A strong high occurs when a new low was formed after the high. If a high failed to make a new low then we consider it a weak high

- A strong low occurs when a new high was formed after the low. uf a low failed to make a new high then we consider it a weak high

In general, we always looking for trade entries :

- With the trend as defined by the last BOS

- And in the direction towards the weak low or weak high

Why do we take trades towards the weak low or weak high? Since we assume that the strong high/low is going to hold. Remember if a Low is able to make a new High then this makes it a very strong low. A lot of money was put into that low to be able to make a new high. So what would we expect after the High? We would expect a pullback to make a higher low. Since there was a lot of money involved in creating a new high we would not expect for price to reverse and take out that strong low. Instead, we expect a pullback to make a new HL, and then take out the weak high to make a new HH

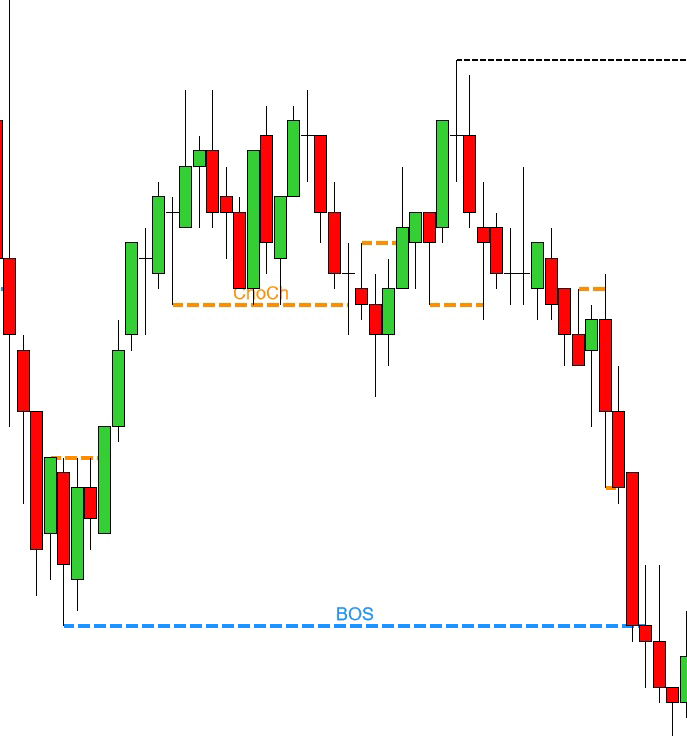

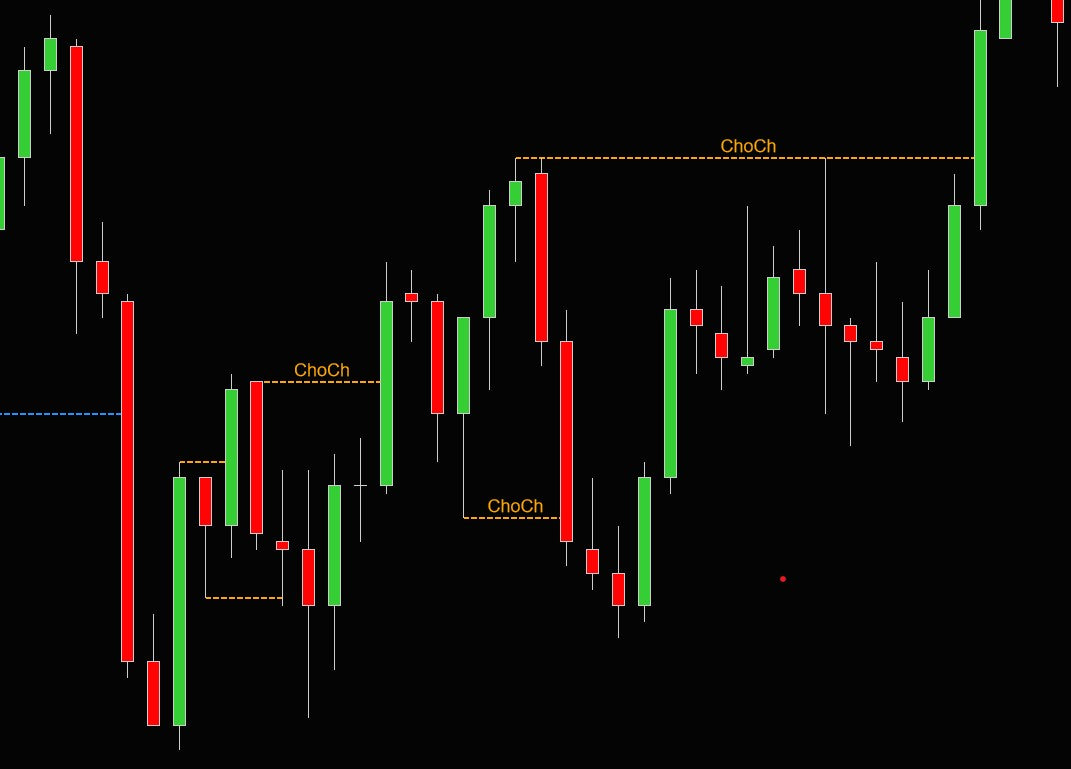

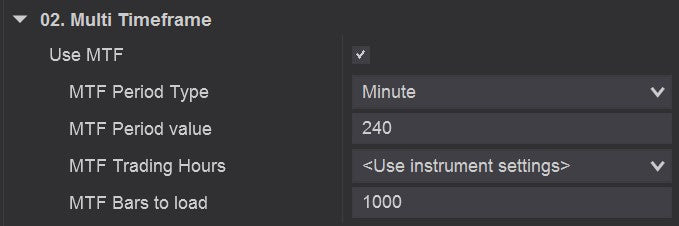

Change of character (ChoCh)

The market substructure is plotting the smaller trend within a bigger trend.

It often shows you the first signs that the trend will pull back or start to reverse. Remember a trend reversal is confirmed by a BOS, However, before we get a BOS we often see a change of character (ChOCh) in the market. When looking for trade entries we always trade in the direction of the BOS. But like we said a BOS by itself is not a trade entry. Instead, we wait for the price to pull back and find then find an entry. Let's say that the trend is bearish, so we had a bearish BOS. Next, we wait for the price to pull back. On a lower timeframe, this pullback often generates a bullish ChoCh. So we wait for a bullish ChoCH on a lower timeframe.. followed by a bearish ChOCH. Now the lower timeframe is aligned with the higher timeframe and the pullback might be over so we can look for a short entry

See the following screenshot which shows a 5min chart with the market structure of both the 15min and 5min timeframes. Note that at the left arrow we get a bullish BOS (blue line) meaning the trend is up. Next, we wait until we get a bullish ChoCH (orange line) on the 5min timeframe which confirms that

Latest updates

Below you will find some videos explaining the latest fetures

Video training course

The indicator comes with an extensive video course describing everything about the indicator, how to trade it, and with numerous trade examples:

Below you will find the first few videos of the course.

Visit the youtube playlist for all videos

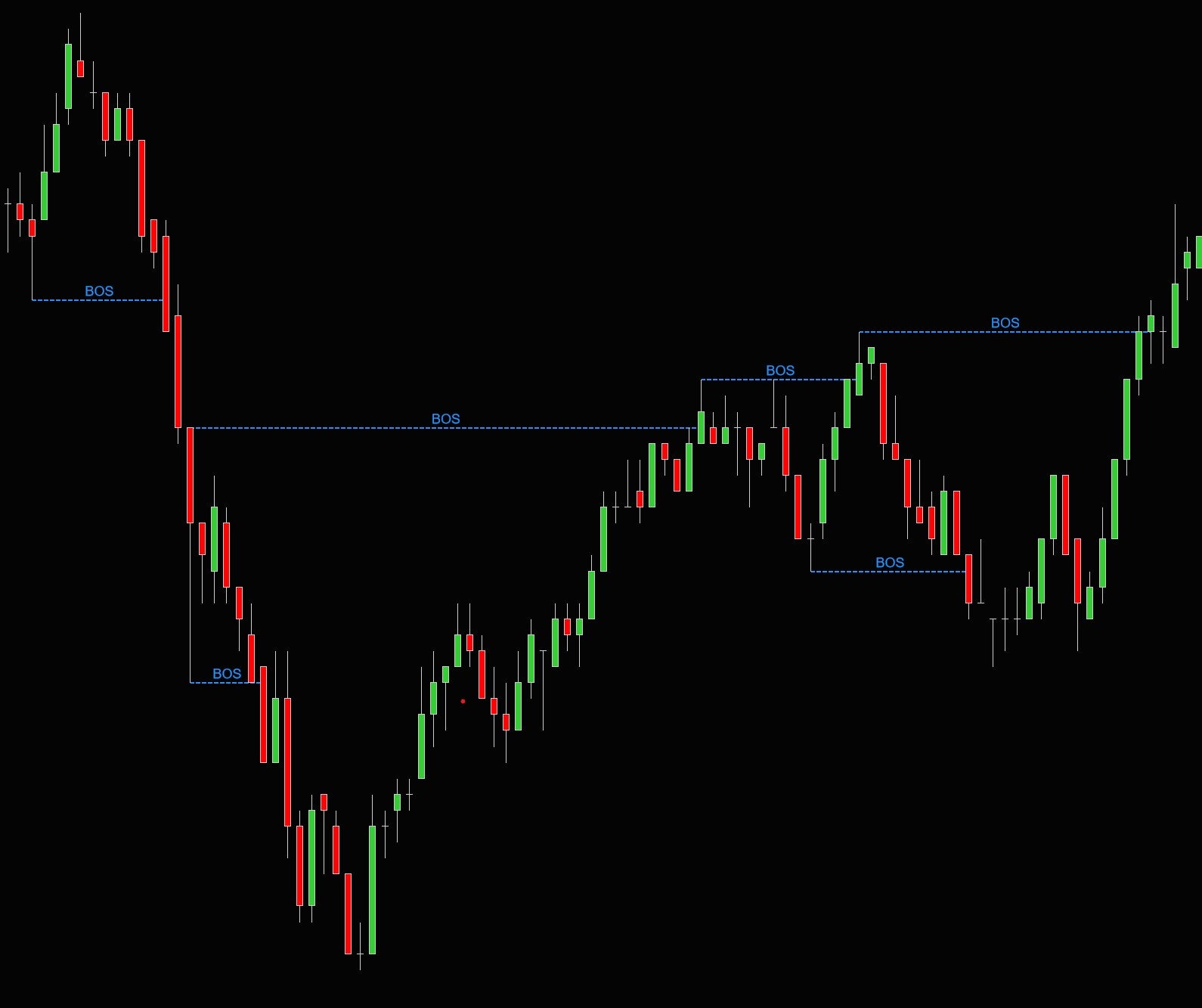

Multi timeframe

One of the unique features of this indicator is the ability to display market structure from multiple timeframes on 1 chart.

The following screenshot shows what that would look like in NinjaTrader.

As you can see we added 4x TDU Market Structure indicators to a 5-min chart.

And each indicator has different settings for the MTF Period and shows the market structure from a different timefrane

That way we can see the 4H, 1H, 15min and 5min market structure , all in 1 chart

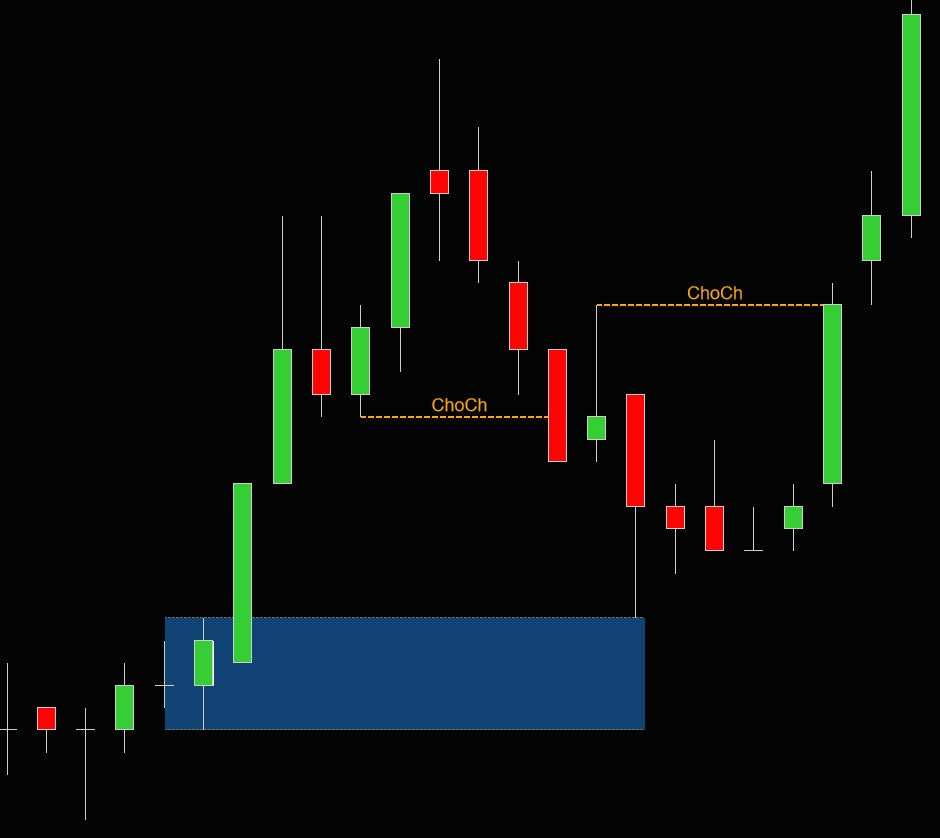

Multi time frame settings

To do this you go to the indicator settings and enable the Use MTF checkbox.

Next, select the timeframe you want to display and that is it. Now the indicator will display the market structure from the timeframe you selected on to your chart.

If you want to show multiple timeframes on 1 chart then just add the indicator multiple times to your chart and change the MTF settings for each instance.

For example, I might have a 1min chart with 4x market structure indicators on it

- 1st indicator is set up to show MTF 1 day

- 2nd indicator is set up to show MTF 240min (4 hours)

- 3rd indicator is set up to show MTF 15min

- and 4th indicator does not use MTF, it just shows the structure for the current chart timeframe:

Supply & Demand

The indicator can show supply/demand levels based on BOS and/or ChoCH

BOS Supply/Demand zones

A BOS supply / demand zones is drawn from the lowest (or highest) point between the start of the BOS and the break of the BOS

If you look at the screenshot on the left you can see the blue BOS (break of structure). You can imagine that a lot of effort was put into making this BOS possible.

A lot of buyers had to step in and push the market higher , and finally cause a break of structure

Now where did the buyers step in ? Where did price reverse from a down to an up trend ? That was right at the bottom between the start and end of the BOS

The indicator can highlight this with a supply shown as you can see in the screenshot.

You can choose to show the supplyzone using the candle's wick only.. The zone will be drawn forward in time until wicked or broken since in general these zones will act as support/resistance zones

ChoCH Supply/Demand zones

A ChoCH supply / demand zones is drawn from last High or Last Low before the ChoCH was made.

For example, on the screenshot to the right, we can see a bearish ChoCH. In this case the last high before the ChoCH is the green up candle. And that is then used to create a supply zone

These supply/demand zones often act as support/resistance zones. But note that ChoCH zones are not as strong as BOS supply/demand zones

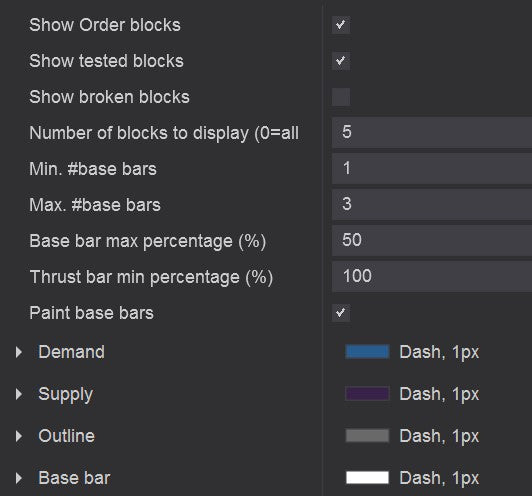

Order blocks

Order blocks are zones which get drawn when price moves out of a consolidation range with force.

After a breakout we often see price re-testing the orderblock before the trend continues

A good example is shown below. We can see a small 4-bar range followed by a big green breakout candle.

The moment the breakout candle closes the indicator will draw the orderblock

and a few bars later we see price retesting the orderblock before the trend continues

Orderblock settings

In the settings you can choose to show the order blocks, and whether or not you want to show tested and broken order blocks and how many order blocks you want to show. In this example it just shows the 5 most recent orderblocks to keep the chart clean

The min/max bars define how many bars should form the before we consider it a range. In this case the range will be detected when the range is 1-3 bars.

The base bar max percentage defines if a bar is considered part of The Thrust bar min percentage defines how big the thrust bar should be to be considered as a break out

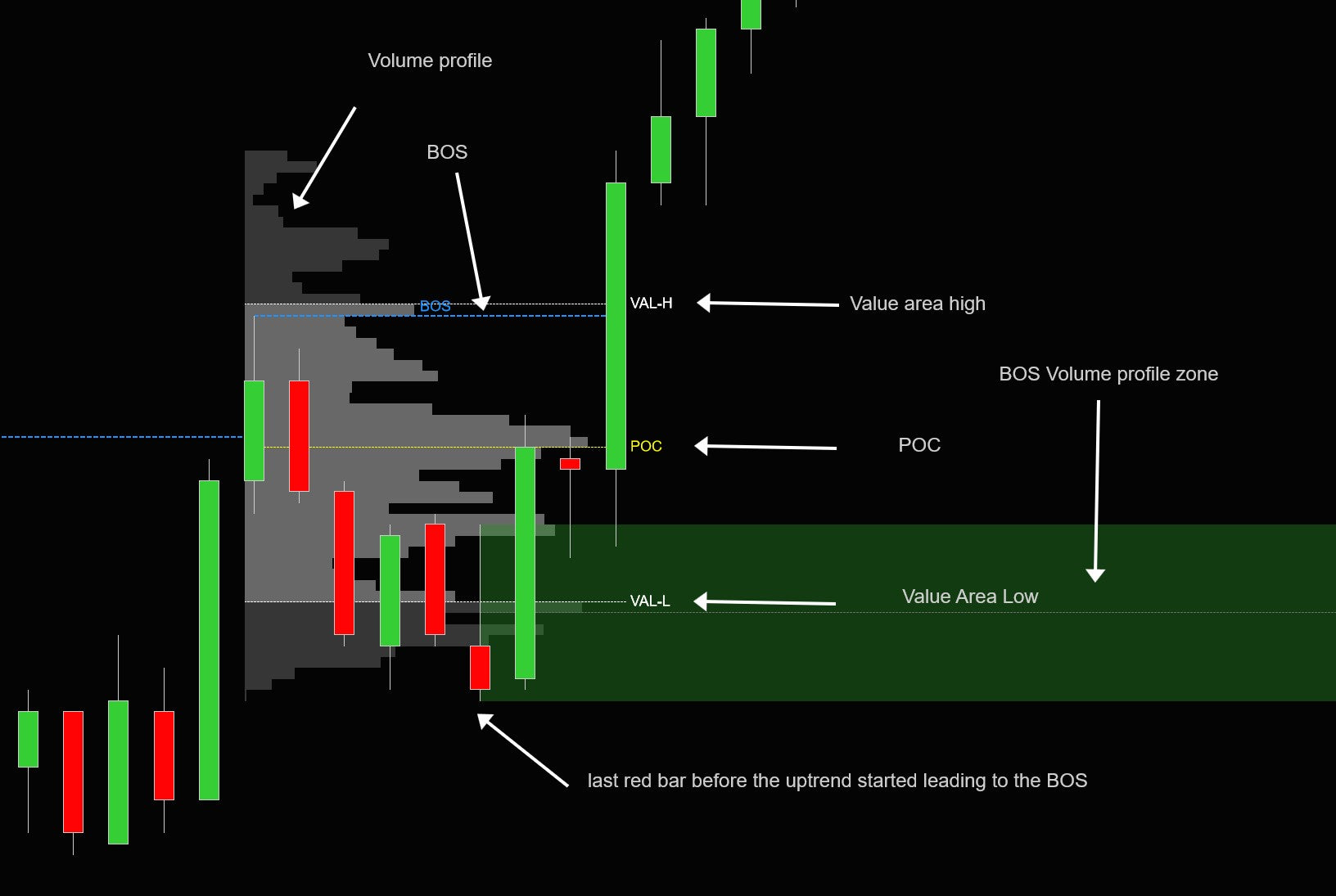

BOS - volume profiles

What is a BOS volume profile ?

A BOS volume profile is a volume profile which gets calculated from the start of the BOS to the break of the BOS line. The volume profile will show where the most traded volume took place to form the BOS together with the point of control (POC) and the value area

In the screenshot above you can see the volume profile, and the Value area high/low and POC lines.

The POC is the price at which most of the trading during the BOS took place

The Value are is the region in which 68% of the volume traded during the BOS took place

As with any volume profile, we often see that the Value Area high, low and POC become important levels. When price retests these levels it could the find liquidity it needs to continue the trend

BOS volume profile zones

Besides showing you the volume profile and value area the indicator can also show 'volume profile zones' These zones will be drown at the last red- bar touching the value area low in an bullish BOS or the last green candle touching the value area high in for a bearish BOS

Again if price comes back to retest these levels you can often expect a reaction or trend reversal / continuation

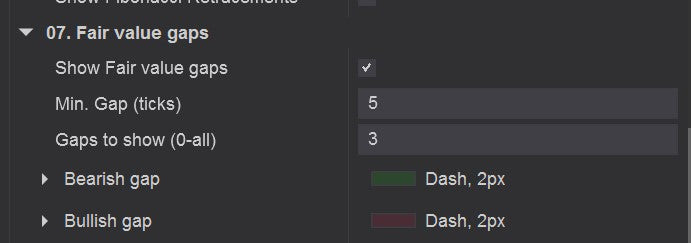

Fair value gaps

Fair Value Gaps are a 3 candlesticks patterns, formed when the 3rd candle does not fully overlaps the 1st candle, leaving a gap in the 2nd candle

Re-tests

In the picture on the left we see a breakout out of a range which leaves a fair value gap. The indicator will show this fair value gap at the close of the 3rd candle.

After the fair value gap is formed , price first moves up, but then comes back to re-test the fair value gap. After re-testing price moves up again resuming the rend

Settings

You can define the min gap in ticks which is usefull for instruments like NQ which are very volatile. For these instruments you might want a bigger gap then for others.

Further more you can choose if you want to show the Fair Value gaps, and if yes.. how many should be shown. In this example only the most recent 3 gaps will be shown on the chart

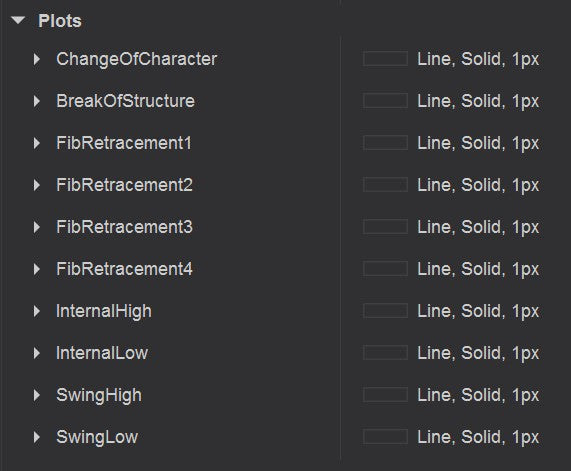

Bloodhound / NinjaScript / Strategy support

The indicator exports all signals and other bar metrics as plots so you can use them from BloodHound*/ ninja script/ strategy builder or your own ninja script strategies.

(

Change log

8-aug-2023 v1.0.1.15

- - added new option to detect structure via fractals (legacy price action mode still supported)

- - added breaker blocks

- - added trendline liquidity

- - added equal low/highs

- - added micro structure

17-may-2023 v1.0.1.12

- fixed issue that dropdown menu appeared multiple times in chart menu after saving workspace and reloading ninjatrade

9-May-2023 v1.0.1.11

- fixed issue that volume profile was not shown or disappeared

30-March-2023 v1.0.1.9

- improved performance

- fixed exception/error

20-March-2023 v1.0.1.8

- added plots for FVG's and Order blocks

- added option to add 2 extra fib retracements

26-Oct-2022 v1.0.1.3

- fixed performance issues

23-Aug-2022 v1.0.1.0

- added option to turn BOS / ChoCh alerts on/off in dropdown menu

- smalf fix: always show BOS/ChoCh structure mapping in settings

- small fix: trend display was delayed when using MTF

08-Aug-2022 v1.0.0.9

- removed empty spots in the dropdown menu

- added a new feature to display the trend in the top left, top right, bottom left, bottom right

- fixed overlapping chocs & BOS labels

- Added Market Swing High/Low plots for bloodhound/strategies

- Added Internal swing High/Low plots for bloodhound/strategies

07-Aug-2022 v1.0.0.8

- added option to the dropdown menu to enable/disable the entire indicator

- added timeframe to chart button

- added timeframe to trend display

07-Aug-2022 v1.0.0.7

- added dropdown menu for easy access to all indicator settings

- added fair value gaps

- added order blocks

- added option to specify how many BOS it takes to consider a trend change

- added much improved BOS & ChoCH detection

- added much more options to change colors & fonts

28-apr-2022 v1.0.0.3

- added option to specify swing structure in ATR, percentage, or ticks

- added option to show BOS/ChoCH as line only, line + text or line + text + timeframe

- added option to only show the last X number of ChoCH

- added option to only show the last X number of BOS

- added option to only show [X} supply/demand zones around the current price

- fixed ChangeOfCharacter plot not working

- added plots for each fib. level which can be used from strategies/bloodhound

23-april-2022 v1.0.0.2

- various bugfixes

31-march-2022 v1.0.0.1

- initial release

Customers also look at

The following products are often combined with the orderflow footprint indicator

Join us on discord

https://launchpass.com/tradedevils-indicators1/member

Want to chat with us and other traders? Got questions on our indicators ? Or want to know more about our products? Then join us on discord for just $1 a year