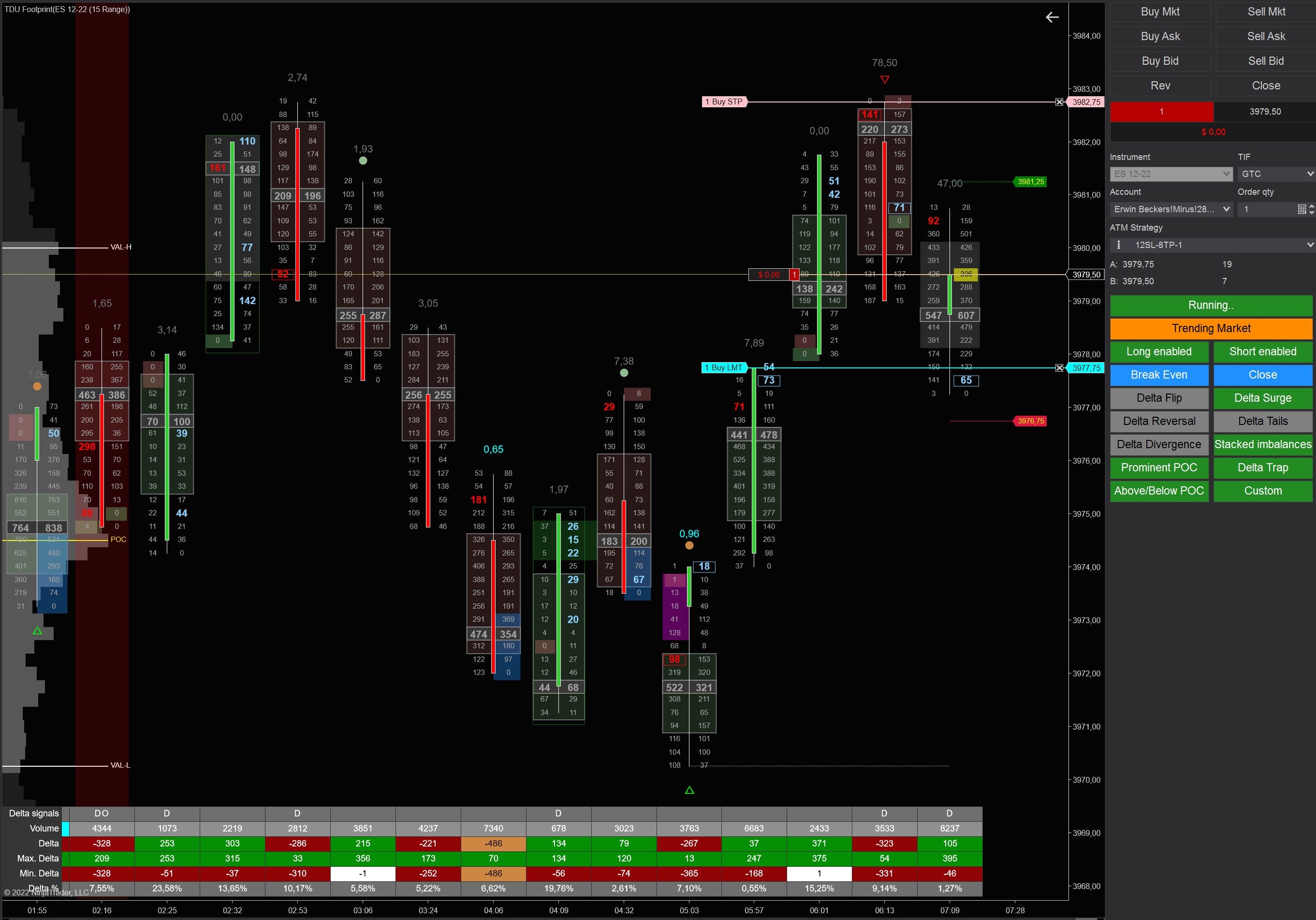

Auto Orderflow Footprint Trader

The most powerful automated orderflow trading strategy for NinjaTrader 8. Build, backtest, and auto-trade any footprint signal — from simple one-click strategies to complex multi-condition rule trees. No coding required.

Stop watching charts all day. The Auto Orderflow Footprint Trader turns your best orderflow insights into fully automated trading strategies. Select from 39 built-in footprint signals, combine them with AND/OR logic in the visual signal designer, configure your position sizing, stop loss, trailing stops, and risk filters — and let the strategy trade for you. From delta divergence to trapped traders, from stacked imbalances to exhaustion prints — if you can see it on a footprint chart, you can auto-trade it.

1. Why Choose This Strategy

Automate Any Orderflow Signal

35 built-in footprint signals are ready to trade out of the box: delta divergence, trapped traders, stacked imbalances, exhaustion prints, delta sweep, volume sequencing, absorption, and many more. Select one or combine multiple signals into powerful multi-condition strategies — no coding needed.

Visual Signal Designer

Build complex trading strategies visually with the AlgoStudio Pro signal designer. Create AND/OR logic trees, compare any orderflow metric against thresholds or price levels, add bar pattern filters, and fine-tune your entries. It's like having a visual programming environment purpose-built for orderflow trading.

Professional Trade Management

Every aspect of trade management is configurable: 6 stop loss types, 5 trailing stop types, break even management, take profit targets, and a scalp + runner dual-position system. Add daily loss limits, drawdown protection, session filters, and more.

Backtest & Optimize

Because the Auto Trader runs as a NinjaTrader strategy, you get full backtesting and optimization support. Test your signal combinations against historical data, analyze performance metrics, and refine your approach before risking real capital.

2. How It Works

The strategy reads real-time orderflow data, evaluates your signal rules on every bar, and automatically enters trades when conditions are met — with full stop loss, target, trailing stop, and risk filter protection.

Step 1: Choose Your Signals

Select from 35 built-in orderflow signals or create custom ones. Each signal detects a specific footprint pattern — like delta divergence, trapped traders, or stacked imbalances — that has proven edge in the markets.

Step 2: Build Your Rules

Use the visual signal designer to combine signals with AND/OR logic. Add filters like bar direction, time of day, volume thresholds, and price conditions. Save your complete strategy as a reusable template.

Step 3: Configure & Trade

Set your position sizing, stop loss, targets, trailing stops, and risk limits. Arm the strategy in Continuous mode for hands-free trading, or use OneShot to take one trade and pause. Full backtesting available.

3. Built-in Trading Signals

The strategy includes 35 built-in orderflow signals that you can enable and combine. Each signal detects a specific footprint pattern that professional traders use to identify high-probability trade setups. Here is every signal available, what it means, and how you can use it in your trading.

Point of Control (POC) Signals

The POC is the price level with the highest traded volume in a bar. It represents where the market found the most agreement. Shifts in POC positioning reveal where institutional participants are active and where the balance of power is shifting.

Above/Below POC

Triggers when a bar's open and close are both above the POC (bullish) or both below the POC (bearish). This means all the buying activity happened above the highest-volume level, showing clear directional commitment.

How to trade it: When a bar opens and closes above the POC, buyers stepped in above fair value and held — this confirms bullish intent. Use as a trend continuation entry, especially when combined with delta confirmation. The opposite (both below POC) confirms sellers are in control.

Bullish / Bearish POC

Detects when the POC is at an extreme position within the bar. A Bullish POC occurs on a green bar where the POC sits in the lowest price levels — aggressive buyers absorbed all selling at the low and pushed price higher. A Bearish POC occurs on a red bar where the POC is near the top — sellers overwhelmed buyers at the high.

How to trade it: A bullish POC at the low of a green bar is one of the strongest reversal signals in orderflow. It means the heaviest volume was at the bottom, yet price still closed up — massive buying absorbed the selling. Look for this at support levels, previous day lows, or after a multi-bar selloff. The configurable tick offset controls how close to the extreme the POC must be (default: 3 levels).

Delta Continuous POC

Detects when the delta direction aligns with the POC trend across consecutive bars. When the POC is rising and delta is positive (or POC is falling and delta is negative), it confirms that the directional move has genuine orderflow backing.

Trading value: Continuous POC with confirming delta is one of the strongest trend continuation signals. It means price acceptance levels are shifting AND aggressive participants are driving the move. Use for adding to winning positions or entering trend pullbacks with high confidence.

Continuous POC

Detects when 2 or more consecutive bars have their POC at the same price level. The market keeps returning to this price, building significant volume acceptance. This marks a strong support or resistance zone.

Trading value: A continuous POC level acts as a magnet price. Trade bounces off this level or watch for a breakout when it finally fails. Combine with delta direction to determine which side will win.

POC Gap

Triggers when the POC of the current bar is above the previous bar's high (bullish gap) or below its low (bearish gap). Value has shifted dramatically between bars — a clear directional signal.

Trading value: POC gaps show institutional urgency. When the entire volume concentration jumps above or below the prior range, large players are driving direction. Use for momentum entries in the gap direction.

POC in Wick

Fires when the POC falls in the bar's wick (shadow) rather than the body. The highest volume was traded outside the open-close range, indicating that price was rejected at that level.

Trading value: A classic rejection signal. The market tested a level heavily (high volume) but ultimately rejected it (POC in wick). Trade in the direction opposite to the wick — if POC is in the upper wick, the market rejected higher prices (bearish).

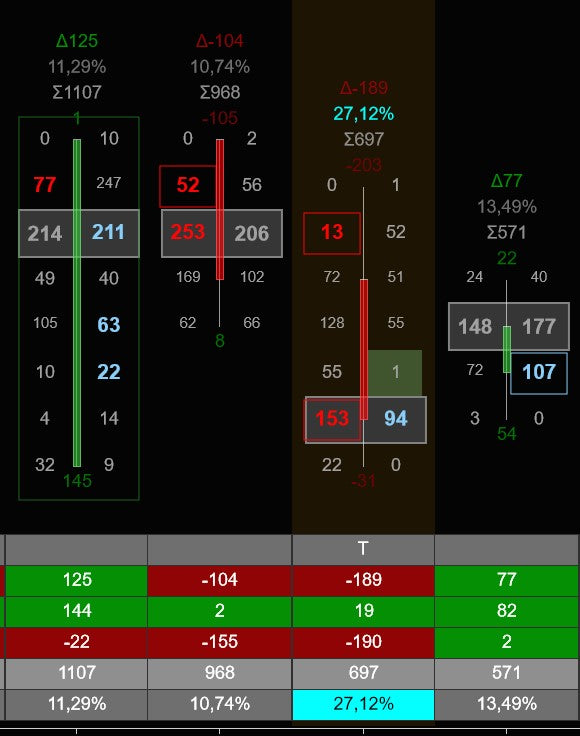

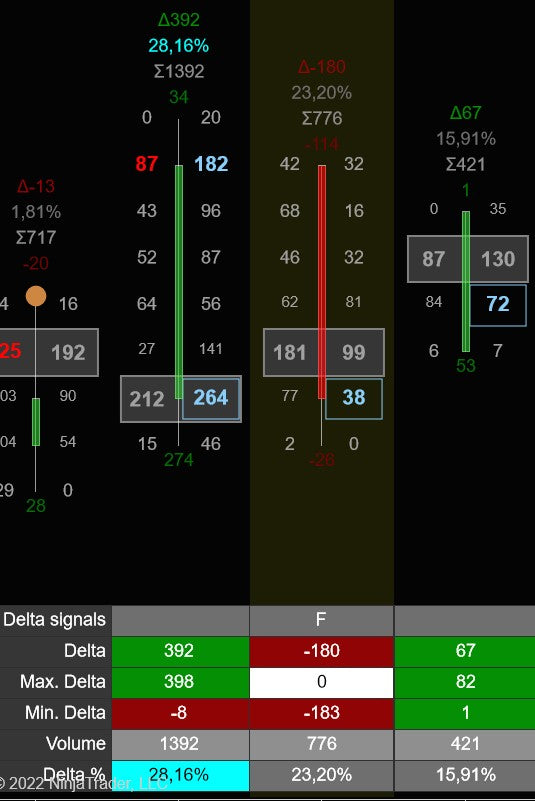

Delta Signals

Delta is the difference between buying volume (ask) and selling volume (bid) at each price level. It reveals who is more aggressive — buyers or sellers. These signals detect specific delta patterns that indicate shifts in market momentum, reversals, and traps.

Delta Rise / Delta Drop

Delta Rise fires when cumulative delta is increasing — buyers are becoming more aggressive. Delta Drop fires when delta is decreasing — sellers are gaining control. These track the momentum of the order flow, not just its direction.

How to trade it: Delta Rise confirms an uptrend is still being driven by aggressive buyers. Use it to stay in winning long trades or add to positions. Delta Drop in an uptrend is an early warning sign — buying pressure is fading even if price hasn't turned yet. Combine with bar direction for high-probability entries.

Delta Tail

Detects when a bar has negative delta at all price levels except the bottom levels (bullish tail), or positive delta at all levels except the top (bearish tail). Think of it as a volume "tail" hanging off the bar. The extreme end of the bar was aggressively traded in the opposite direction from the rest.

How to trade it: A bullish delta tail means sellers dominated the entire bar except at the very bottom, where aggressive buyers stepped in and absorbed the selling. This is a powerful reversal signal, especially at key support levels. The opposite for bearish. Delta tails often precede multi-bar reversals.

Delta Flip

Fires when delta changes sign from the previous bar. A flip from negative to positive means buyers have taken control. A flip from positive to negative means sellers have gained the upper hand.

Trading value: Delta flips catch the exact bar where control shifts between buyers and sellers. Use as an early reversal or continuation confirmation signal. Powerful when combined with above/below POC or bullish/bearish POC.

Delta Reversal

Detects when bar color contradicts delta direction. A green (up) bar with negative delta means price went up despite more selling — shorts are being squeezed. A red (down) bar with positive delta means buyers are being trapped.

Trading value: One of the most insightful orderflow signals. When price direction and delta direction disagree, something unusual is happening beneath the surface. Green bar + negative delta often precedes a pullback. Red bar + positive delta often precedes a bounce.

Delta Trap

Identifies delta traps — situations where aggressive participants on one side get trapped as the market reverses against them. Bullish trap: sellers pushed delta negative but price closed above open. Bearish trap: buyers pushed delta positive but price closed below open.

Trading value: Trapped traders are forced to exit, fueling the move against them. When you spot a delta trap, you're trading with the side that just "won" while the losers are forced to cover. This creates momentum in your direction.

Close at Min/Max Delta

Triggers when the bar closes near its minimum or maximum delta reading during the bar's formation. If the bar closes near max delta, buying pressure held strong until the very end. If near min delta, selling pressure accelerated into the close.

Trading value: Where delta sits at the close tells you who was in control at the moment of truth. A close at max delta on a green bar means buyers were aggressive right to the end — strong continuation signal.

Delta Sweep

Detects when an aggressive buyer or seller sweeps across multiple price levels in a single bar. The market sweep count tracks how many consecutive levels were taken by one side. A minimum level count (configurable, default: 3 levels) must be swept with volume below a maximum threshold (default: 5) to qualify — ensuring the sweep was a fast, aggressive move rather than slow accumulation.

How to trade it: Delta sweeps are institutional footprints. When a large player needs to fill a big order, they sweep through multiple levels quickly. This leaves a trail of low-volume levels with consistent directional delta. Trade in the direction of the sweep as a momentum continuation signal.

Delta Slingshot

A reversal pattern where the market is pushed sharply in one direction, then snaps back violently in the opposite direction — like a slingshot being released. Combines aggressive delta in one direction followed by an even more aggressive reversal.

How to trade it: The slingshot catches the exact moment when one side overextends and gets punished. It combines delta extreme with directional reversal. Enter in the slingshot direction (the snap-back) with the knowledge that trapped traders from the initial push will fuel further movement.

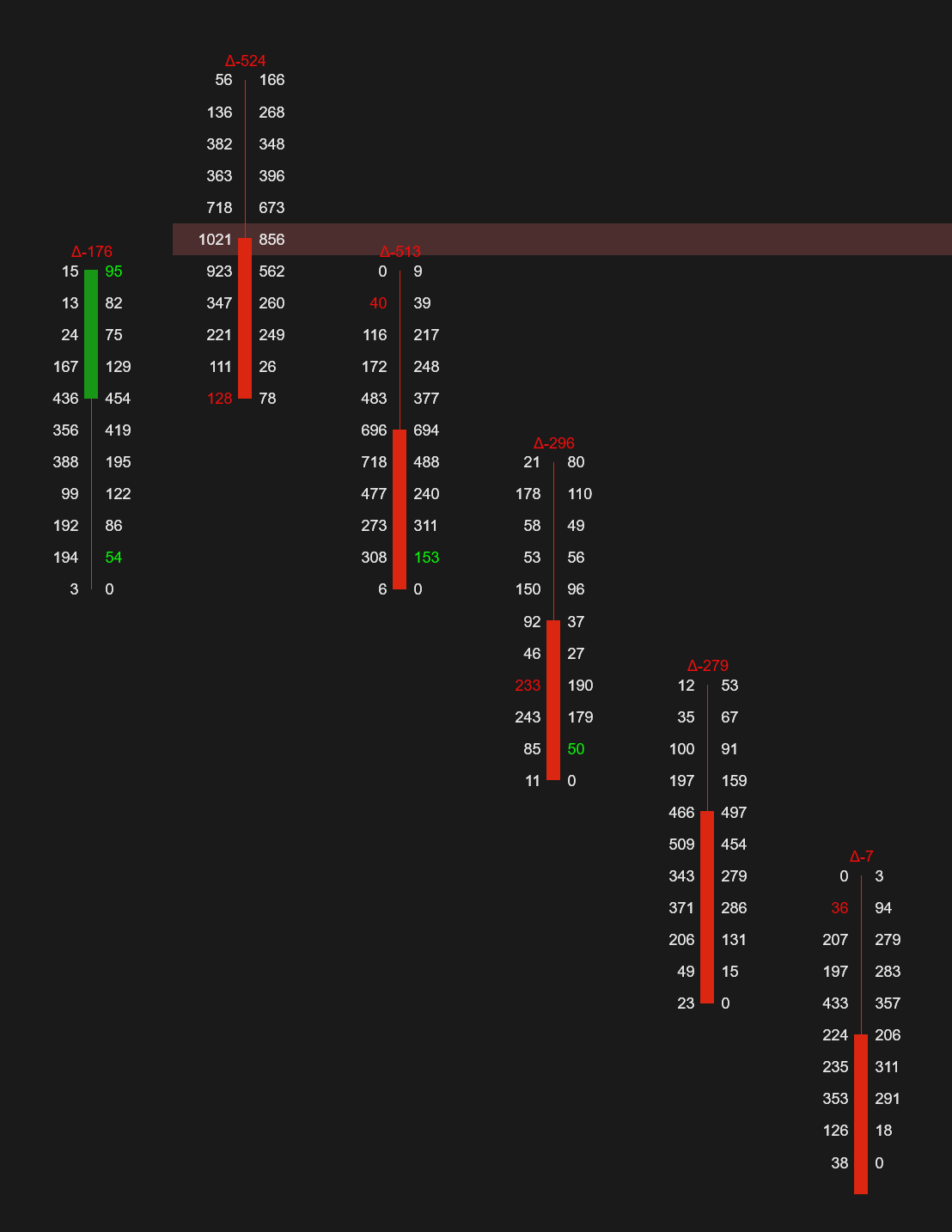

Imbalance Signals

Imbalances occur when volume on one side of the book (bid or ask) significantly outweighs the other at a specific price level. They mark where aggressive participants overwhelmed passive orders. The strategy detects several types of imbalance patterns:

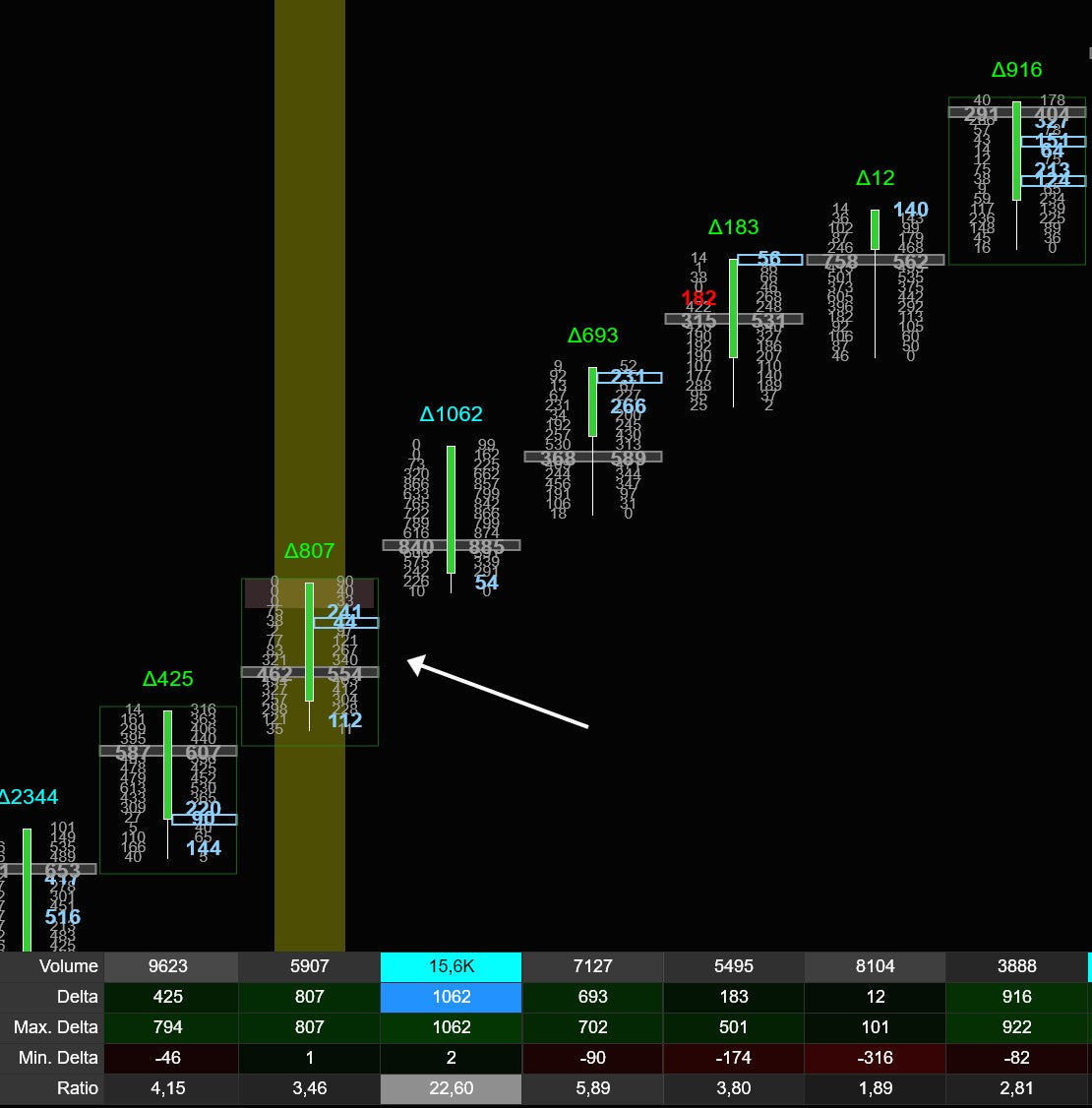

Stacked Imbalances

Detects when 3 or more consecutive price levels (configurable) all show the same type of imbalance (all buy or all sell). This creates a "stack" of imbalances that represents a wall of aggressive directional volume. These are among the strongest institutional signals in orderflow.

Trading value: Stacked buy imbalances act as support levels that the market will likely return to test. Stacked sell imbalances act as resistance. Trade bounces off these levels or use them as entry points for trend continuation. Configurable: minimum stack count, detection at candle high/low only vs. all positions.

Reversal Imbalances

Identifies imbalances that contradict the bar's direction, suggesting the trend may be losing momentum. For example, sell imbalances appearing in a green bar indicate selling pressure underneath the surface bullishness.

Trading value: These are early warning signals that the current move is running out of steam. When you see reversal imbalances, consider tightening stops or preparing for a counter-trend entry. The minimum volume filter (default: 10) ensures only significant imbalances trigger.

Inverse Imbalances

Detects counter-trend imbalances — imbalances that go against the prevailing direction. When a minimum count (configurable, default: 2) of inverse imbalances appear in a bar, it suggests the opposing side is building strength.

Trading value: Inverse imbalances within a trending bar are breadcrumbs left by counter-trend participants. Multiple inverse imbalances mean the counter-trend side is getting organized. Watch for follow-through in the next bars.

Multiple Imbalances

Triggers when a single bar contains 3 or more imbalances (configurable) of the same type. More imbalances in one bar means more aggressive directional activity at multiple price levels — the entire bar was dominated by one side.

Trading value: A bar packed with buy imbalances shows aggressive institutional buying across the entire range. These bars often become anchors for future support. Use for strong directional entries or to confirm a breakout.

Volume & Momentum Signals

These signals detect patterns in how volume is distributed across bars and price levels, revealing exhaustion, absorption, and shifts in market participation.

Exhaustion Prints

Detects when a bar shows very low volume at its extreme (high or low). In an uptrend, tiny volume at the bar's high means buyers ran out of steam. In a downtrend, tiny volume at the low means sellers are exhausted. Configurable threshold (default: 8 consecutive low-volume levels).

How to trade it: Exhaustion prints are one of the most reliable reversal signals. When a trending bar can't attract volume at its extreme, the trend is running on fumes. Look for exhaustion prints at swing highs/lows, then enter in the reversal direction. Combine with delta confirmation for the highest probability.

Volume Sequencing

Detects when volume increases consistently across consecutive price levels from the bar's extreme inward. Like a crescendo of volume building toward the POC. Configurable threshold (default: 5 consecutive increasing levels).

Trading value: Bullish sequencing (volume increasing from the low upward) confirms strong absorption of selling. Bearish sequencing (increasing from the high downward) confirms strong selling into buying. Use to confirm genuine directional strength vs. false breakouts.

Fading Momentum

Identifies when buying or selling momentum is weakening relative to the previous bars. The current bar's delta is weaker than the lookback period average (configurable, default: 3 bars), even though price is still moving in the same direction.

Trading value: Fading momentum catches trends before they reverse. Price is still trending, but the fuel (delta) is drying up. Tighten stops, take partial profits, or prepare for a counter-trend entry. This is an early warning system for trend exhaustion.

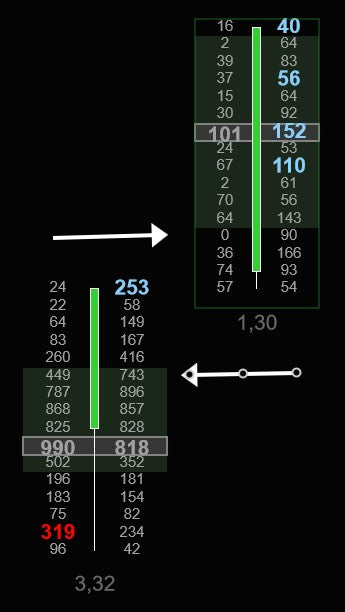

Stopping Volume

Detects a sudden volume spike that stops price momentum. The market was moving in one direction, then a large volume bar appears that halts the move. Compares against the lookback period (default: 3 bars).

Trading value: Stopping volume marks where large participants stepped in to absorb directional pressure. These levels become strong support/resistance. Trade the reversal from the stopping volume level, or use it to set your stop loss on the other side.

Absorption

Identifies when large passive orders absorb aggressive orders without price moving. Aggressive sellers hit the bid repeatedly, but a large passive buyer keeps absorbing the volume — preventing price from dropping (or vice versa). Lookback period configurable (default: 4 bars).

Trading value: Absorption is the fingerprint of institutional limit orders. When a large player parks a limit order at a price level and keeps absorbing everything thrown at it, the market will eventually move in their direction when the selling/buying dries up.

Trapped Traders

Detects when market participants get stuck in unfavorable positions. Example: aggressive sellers push price to a new low, but the bar closes as a green (up) bar — those sellers are now trapped short at the bottom. They'll be forced to cover, fueling the reversal.

Trading value: One of the highest edge signals available. Trapped traders must exit their positions, creating predictable buying/selling pressure. Trade in the direction that punishes the trapped side. Combine with stacked imbalances or delta tail for devastating accuracy.

Delta Divergence

Detects when price and delta disagree. Three configurable types: (1) Session new high/low vs. delta — price makes new session extremes but delta doesn't confirm; (2) Candle new high/low vs. delta; (3) Candle color vs. delta direction. Lookback period configurable (default: 5 bars).

Trading value: Divergence between price and delta is a classic institutional footprint. When price makes new highs but buying delta is weaker, smart money may be distributing. When price makes new lows but selling delta is weaker, accumulation may be underway.

OFT7 Advanced Signals

Four new advanced orderflow signals that detect hidden divergences, momentum shifts, fading pressure, and passive institutional activity. Each signal provides a unique edge that complements the existing signal library. All OFT7 signals support the Swing Filter for cleaner, trend-aligned detection.

Delta Price Divergence

Compares delta direction against price direction within the same bar. When delta and price move in opposite directions, the visible price action is not supported by the underlying order flow.

- Bullish: Negative delta but price closed higher — hidden buying is present

- Bearish: Positive delta but price closed lower — hidden selling is present

How to trade it: Delta Price Divergence is an intra-bar signal (not multi-bar like regular divergence). It reveals hidden buying/selling that isn't visible from the candle alone. When price goes up but delta is negative, passive buyers are absorbing aggressive selling. Use it for reversal entries or to confirm existing setups.

POC Momentum Wave

Tracks whether the Point of Control is consistently shifting direction across consecutive bars. A bullish wave means the POC dipped then recovered — volume distribution is shifting higher. A bearish wave means the POC popped then dropped.

Trading value: Confirms trend direction using volume distribution rather than price alone. When the POC keeps moving higher, the market is accepting higher prices — even if candle direction is mixed. Great as a trend filter for other signals.

Bid/Ask Fade

Detects when volume on one side diminishes across consecutive price levels at the bar's extreme, signaling that the losing side is withdrawing.

- Bullish: Green bar where bid volume at the bottom 3 price levels is declining upward — selling pressure is fading at the low

- Bearish: Red bar where ask volume at the top 3 price levels is declining downward — buying pressure is fading at the high

Trading value: Unlike absorption (which detects passive orders), fade detects withdrawal of aggressive orders — a different but equally important sign of directional change. Trade in the direction the fading side is losing.

Passive Absorption

Detects bars where above-average volume concentrates at the price extreme and tapers off moving inward. This pattern reveals passive limit orders absorbing aggressive market orders at the bar's edge — a sign that a large player is defending a price level. Configurable minimum levels (default: 4) and minimum edge volume.

How to trade it: Passive absorption identifies levels where strong passive orders are sitting. These levels are likely to hold on retests. Enter near the absorption level with tight stops just beyond it. If the passive order gets overwhelmed (price breaks through with volume), the level is invalidated.

Value Area Signals

Engulfing Value Area

Triggers when the current bar's value area completely engulfs the previous bar's value area. The current bar traded a wider range of accepted prices, indicating increased market participation and a potential breakout from the previous range.

Trading value: An engulfing value area shows that the market is expanding its accepted price range. Combined with directional delta, this confirms breakouts. If the engulfing happens on high volume with strong delta, the breakout has institutional backing.

Value Area Gap

Detects when there's a gap between consecutive bars' value areas. The current bar's value area doesn't overlap with the previous bar's — value has shifted entirely. Configurable minimum gap size in ticks (default setting available).

Trading value: Value area gaps show that the market has moved to an entirely new area of accepted prices. This is a strong directional signal — trade in the direction of the gap. The gap itself often becomes support/resistance on any pullback.

Print & Level Signals

These signals identify specific volume conditions at individual price levels, marking areas of high institutional interest or absence that become future support, resistance, and retest targets.

Thin Prints

Price levels with very low volume in a bar. Thin print threshold is configurable.

Trading value: Thin prints indicate levels the market moved through quickly without acceptance. These become targets for future retests — the market often returns to "fill" thin print areas.

Zero Prints

Price levels where zero volume traded on one side (bid or ask). A complete absence of participation.

Trading value: Zero prints show levels the market completely rejected. They become strong support/resistance. Also used to identify flash moves that left "gaps" in the orderflow.

Fat Prints

Price levels with exceptionally high total volume (bid + ask). Threshold configurable (default: 1000).

Trading value: Fat prints mark heavy institutional activity at specific levels. These are high-conviction support/resistance zones. The market often bounces off fat print levels on retests.

Big Delta

Price levels where the delta exceeds a configurable threshold (default: 600).

Trading value: Big delta levels show extreme directional aggression at a single price. These mark where institutional participants were most active. Use as support/resistance or entry confirmation.

Market Sweep

Aggressive orders sweeping across multiple price levels with low volume per level. Min levels: 3, max volume per level: 5 (configurable).

Trading value: Market sweeps are the footprint of aggressive algorithmic or institutional orders eating through the book. Trade in the direction of the sweep for momentum continuation.

Unfinished Business

Price levels that were gapped over or rejected, leaving "unfinished" orderflow levels behind. Auto-hides when the level gets tested.

Trading value: Unfinished business levels are magnets for price. The market often returns to fill these levels. Use them as targets for take-profit or watch for entries when price approaches them.

More Imbalance & Ratio Signals

2nd Slot Imbalance

Highlights the second-most significant imbalance level in a bar — the level just below the most extreme.

Trading value: When both the top imbalance and 2nd slot show the same direction, the signal is stronger. Useful for confirming single imbalance readings aren't isolated noise.

Consecutive Imbalances

Fires when consecutive bars all show the same type of imbalance — a sustained directional bias across multiple bars.

Trading value: Unlike stacked imbalances (within one bar), consecutive imbalances track persistence across bars. Multiple bars in a row with buy imbalances shows sustained institutional buying. Use for trend continuation entries and to avoid fading a strong move.

Big Imbalance

Detects a single imbalance that exceeds a large volume threshold. These are exceptionally aggressive orders at a single price level.

Trading value: Big imbalances mark price levels where a large participant made their intentions clear. These become anchors for support/resistance. Trade bounces off big imbalance levels or use them to confirm breakout direction.

Oversized Imbalance

Detects imbalances where the volume ratio between bid and ask is extremely one-sided. More extreme than regular imbalances, indicating overwhelming directional force.

Trading value: Oversized imbalances are rare but powerful. They mark levels where one side of the market had virtually no opposition. These levels become the strongest support/resistance zones on retest.

Ratio

Fires when the bar's ask-to-bid volume ratio exceeds a configurable threshold, indicating extreme one-sided activity across the entire bar.

Trading value: A high ratio means the bar was dominated by one side. Use to filter for bars where directional conviction was overwhelming. Combine with delta and price direction for high-probability entries.

4. Visual Signal Designer (AlgoStudio Pro)

The AlgoStudio Pro signal designer is the brain of the Auto Trader. It's a visual rule builder that lets you create sophisticated trading strategies without writing a single line of code. Build logic trees with AND/OR conditions, compare any orderflow metric against thresholds, filter by bar patterns, price levels, and time — all through an intuitive drag-and-drop interface.

If you can describe a trading rule in words, you can build it in the signal designer. No coding required.

How the Signal Designer Works

Every strategy is a logic tree made up of rules and signals. A rule groups conditions together with AND (all must be true) or OR (any can be true). Each rule contains one or more signals, and each signal has a Long expression and a Short expression. When a Long expression evaluates to true, the strategy generates a buy signal. When a Short expression evaluates to true, it generates a sell signal.

Logic Conditions

AND — All signals in the rule must fire simultaneously. Use for high-probability, multi-confirmation setups.

OR — Any signal in the rule can trigger the entry. Use when you want to catch multiple types of setups.

Rules can contain sub-rules, letting you nest AND/OR logic for complex strategies like: (Signal A AND Signal B) OR (Signal C AND Signal D)

Trigger Modes

Continuous — The signal evaluates on every bar and fires whenever conditions are met. Use for strategies that trade repeatedly.

OneShot — The signal fires only once when the condition first becomes true, then disarms. Use for "wait for setup, take one trade" strategies.

Expression Builder

Each signal expression compares a left field against a right field using an operator. Both fields support lookback (BarsAgo) so you can compare current values to previous bars. Here are all the options:

| Field Type | Options | Use Case |

|---|---|---|

| Orderflow | 94 metrics — 33 numeric: Volume, Delta, MinDelta, MaxDelta, DeltaRate, DeltaChange, DeltaChangePercentage, DeltaEfficiency, DeltaPercentage, DeltaStandardDeviation, VolumePerSecond, VolumeChange, VolumePercentage, VolumeStandardDeviation, COTHigh, COTLow, Ratio, CumulativeDelta, CumulativeVolume, POC, ValueAreaHigh, ValueAreaLow, TotalBuyVolume, TotalSellVolume, Trades, TradesStandardDeviation, BidAskRatio, FatPrintCount, BigDeltaCount, ZeroPrintCount, MarketSweepCount, MinVolumeChanged, MaxVolumeChanged — plus 61 boolean signals: HasBullishAbsorption, HasBearishAbsorption, HasContinuousImbalance, HasBullishContinuousPocSignal, HasBearishContinuousPocSignal, HasBullishDeltaDivergence, HasBearishDeltaDivergence, HasBullishDeltaTrap, HasBearishDeltaTrap, HasDeltaRise, HasDeltaFlip, HasDeltaTail, HasDeltaReversal, HasDeltaDrop, HasDeltaSweep, HasCloseAtMinMaxDelta, HasDeltaSlingShot, HasEngulfingValueArea, HasBuyExhaustionPrint, HasSellExhaustionPrint, HasBullishFadingMomentum, HasBearishFadingMomentum, HasBullishInverseImbalance, HasBearishInverseImbalance, Has2NdSlotBuyImbalance, Has2NdSlotSellImbalance, HasBullishPOC, HasBearishPOC, HasPOCGap, HasOpenAndCloseAbovePOC, HasOpenAndCloseBelowPOC, HasBullishPOCInWick, HasBearishPOCInWick, HasBullishReversalImbalance, HasBearishReversalImbalance, HasBullishStoppingVolume, HasBearishStoppingVolume, HasBullishThinPrint, HasBearishThinPrint, HasBullishTrappedTraders, HasBearishTrappedTraders, HasBullishUnfinishedBusiness, HasBearishUnfinishedBusiness, HasBuyVolumeSequencing, HasSellVolumeSequencing, HasBullishValueAreaGap, HasBearishValueAreaGap, HasBullishStackedImbalances, HasBearishStackedImbalances, HasMultipleBuyImbalances, HasMultipleSellImbalances, HasBullishDeltaPriceDivergence, HasBearishDeltaPriceDivergence, HasBullishPocMomentumWave, HasBearishPocMomentumWave, HasBullishBidAskFade, HasBearishBidAskFade, HasBullishPassiveAbsorption, HasBearishPassiveAbsorption, HasBullishPOCGap, HasBearishPOCGap | Compare any orderflow metric against a threshold, another metric, or its value from N bars ago |

| Direction | Green, Red, Doji, Hammer, Inverted Hammer, Inside Bar, Engulfing Bar | Filter entries by candlestick pattern. Example: "Only take long signals on green bars" or "Only enter after a hammer pattern" |

| Price | Open, Close, High, Low, BodyTop (max of open/close), BodyBottom (min of open/close), Range (high-low in ticks), BodyRange (close-open in ticks) | Compare price levels. Example: "Close > previous bar High" for breakout entries |

| Time | Time picker for session-based filtering | Only trade during specific hours. Example: "Only trade between 9:30 and 11:00" |

| Fixed | Any numeric value | Compare a metric against a fixed number. Example: "Delta > 500" |

| Swing Low | Swing low detection with configurable strength (bars) | Compare price to recent swing lows for support-based entries |

| Swing High | Swing high detection with configurable strength (bars) | Compare price to recent swing highs for resistance-based entries |

Operators

The Crosses Above and Crosses Below operators are especially powerful — they fire only on the exact bar where one value crosses another, avoiding repeated signals while a condition remains true.

Templates

Save your complete strategy configurations as .algo template files. Load them instantly to switch strategies, share them with other traders, or keep a library of setups for different market conditions. The strategy supports up to 16 custom signal templates that can be loaded with one click from the control panel.

5. Trade Execution Settings

Control exactly how and when the strategy enters trades. These settings determine the order type, timing, and strategic behavior of the auto trader.

| Setting | Options | Description |

|---|---|---|

| Order Type | Market Order, Limit Order | Market Order enters at the current market price for fastest fills. Limit Order places a limit order at a configurable offset from the signal price — useful for getting better fills on pullbacks. The offset (in ticks) controls how far from the current price the limit order is placed. |

| Entry Type | OnBarClose, Realtime | OnBarClose waits for the bar to complete before entering — prevents false signals from incomplete bars. Realtime enters immediately when the signal fires during bar formation — faster entries but may trigger on incomplete patterns. |

| Arm Mode | Paused, OneShot, Continuous | Paused disables all trading. OneShot takes one trade, then automatically pauses. Continuous trades every signal that fires until you stop it. OneShot is great for discretionary traders who want the strategy to handle one specific setup. |

| Signal Combination | Many, Any, All | Controls how multiple signals combine: Many requires the specified number of conditions. Any triggers when at least one signal fires. All requires every signal to fire simultaneously. |

| Trade Direction | Long, Short, Both | Restrict the strategy to long-only, short-only, or allow both directions. Useful for trading only in the direction of a higher-timeframe trend. |

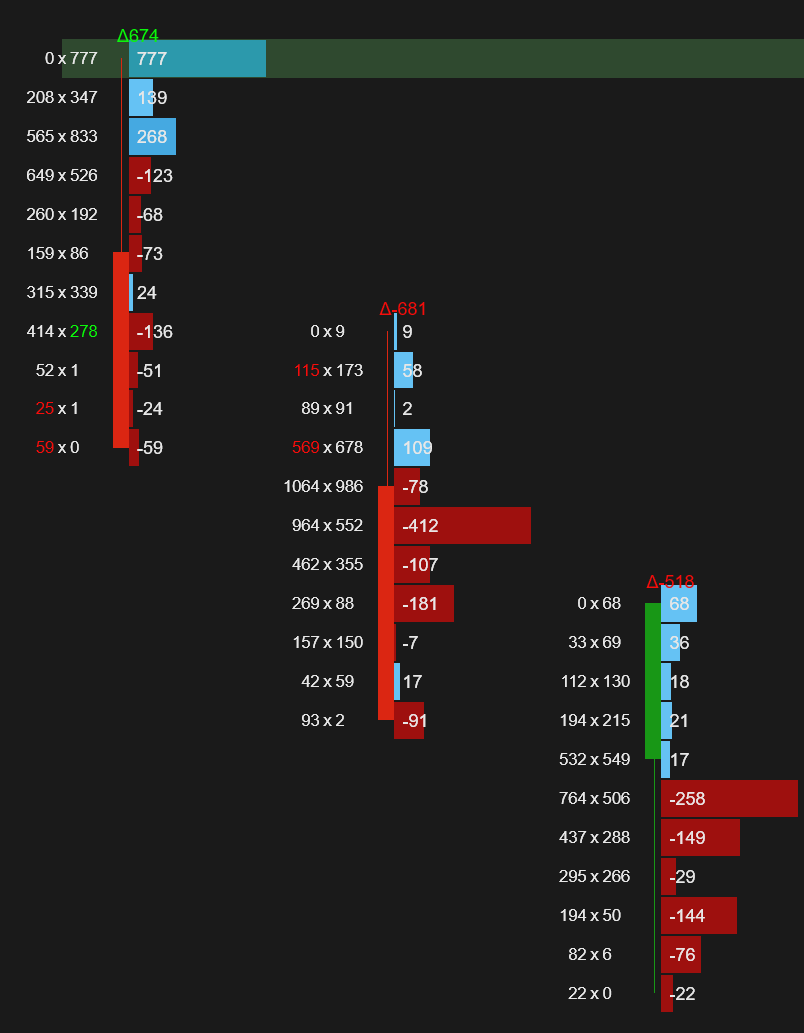

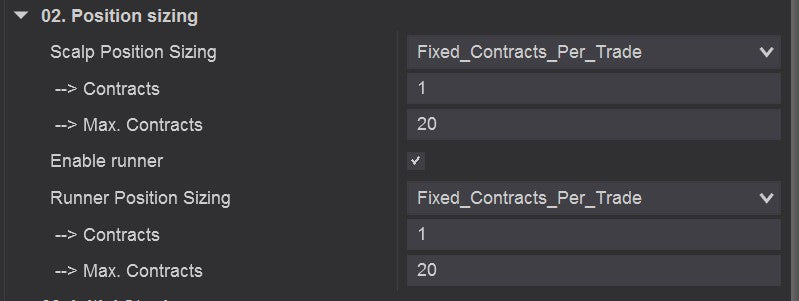

6. Position Sizing

Three professional position sizing modes let you scale your risk appropriately. Separate settings for scalp and runner positions give you granular control over how much capital goes to quick profits vs. extended moves.

| Mode | How It Works | Best For |

|---|---|---|

| Fixed Contracts Per Trade | Enter with a fixed number of contracts every time. Simple and predictable. | Traders who want consistent position sizes regardless of account balance |

| Fixed Amount Per Trade | Risk a fixed dollar amount per trade. The strategy calculates contract size based on your stop distance. | Consistent dollar risk per trade. As stops get tighter, position size increases; as stops get wider, it decreases. |

| Percentage Per Trade | Risk a percentage (0-100%) of your account balance per trade. | Scale position sizes as your account grows or shrinks. True proportional risk management. |

A max contracts limit prevents oversized positions regardless of the sizing calculation.

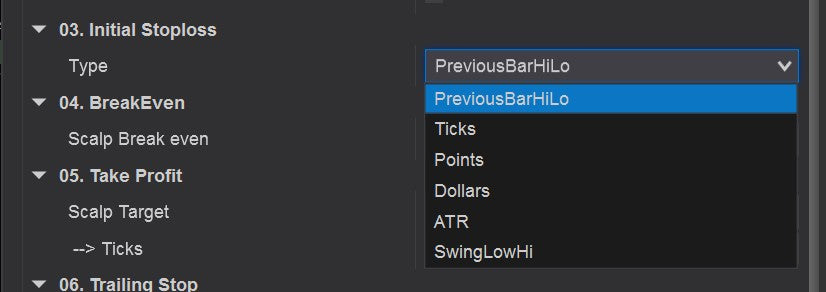

7. Stop Loss Management

Protecting your capital is non-negotiable. The Auto Trader offers 6 different stop loss types, each designed for different market conditions and trading styles. Every trade gets a stop loss — no exceptions.

| Stop Type | How It Works | Best For |

|---|---|---|

| Ticks | Fixed number of ticks from entry price | Simple, predictable risk. Good for scalping with tight stops. |

| Points | Fixed number of points from entry | Same as ticks but measured in instrument points. |

| Dollars | Fixed dollar amount risk per trade | Consistent dollar risk regardless of instrument. The strategy calculates the stop distance based on contract value. |

| ATR | Stop based on Average True Range. Configurable period and multiplier. | Adaptive stops that widen in volatile markets and tighten in quiet markets. Professional standard for dynamic risk management. |

| Swing High/Low | Places stop at the most recent swing high (for shorts) or swing low (for longs). Configurable swing strength. | Structure-based stops that respect market levels. The stop sits behind a proven support/resistance level. |

| Previous Bar High/Low | Places stop at the previous bar's high (for shorts) or low (for longs) | Fast, reactive stop placement based on the most recent price action. Good for short-term strategies. |

All stop types support a configurable offset in ticks for additional buffer beyond the calculated stop level.

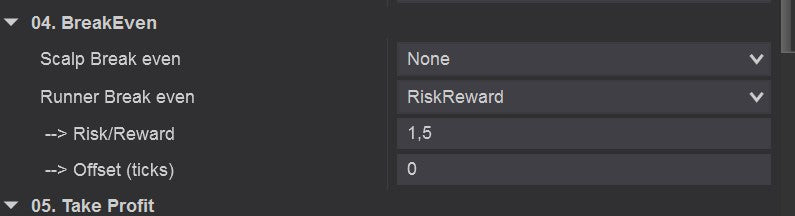

8. Break Even

Once a trade moves in your favor, the break-even feature moves your stop loss to entry price, eliminating risk on the trade. You've locked in a risk-free position and can let the runner work. Separate break-even settings for scalp and runner positions.

| Break-Even Type | How It Works |

|---|---|

| None | Break-even disabled — stop stays at original level. |

| Ticks | Move to break-even when price reaches a fixed number of ticks in profit. |

| Points | Move to break-even when price reaches a fixed number of points in profit. |

| Dollars | Move to break-even when unrealized profit reaches a dollar amount. |

| ATR | Move to break-even when price moves one ATR (with configurable period and multiplier) in your favor. |

| Risk/Reward | Move to break-even when the trade reaches a configurable risk-to-reward ratio (e.g., 1:1 means the profit equals the initial risk). |

A configurable offset lets you move the stop slightly above or below exact break-even — for example, moving to break-even + 2 ticks to ensure at least a small profit.

9. Take Profit & Targets

Set profit targets to automatically exit winning trades. The same 5 flexible target types are available for both the scalp position (quick exit) and the runner position (extended target or no target for trend following).

| Target Type | How It Works |

|---|---|

| None | No target — position stays open until stop or trailing stop is hit. Ideal for trend-following runners. |

| Ticks | Fixed tick target from entry price. |

| Points | Fixed point target from entry. |

| Dollars | Close when profit reaches a dollar amount. |

| ATR | Target based on ATR (period + multiplier). Adapts to current volatility — wider targets in volatile markets, tighter in quiet ones. |

| Risk/Reward | Set target as a multiple of your initial risk. Example: 2.0 means your target is 2x your stop loss distance. |

10. Trailing Stops

Trailing stops follow price as it moves in your favor, locking in profits while giving the trade room to breathe. 5 trailing stop methods are available, each with a configurable trigger that determines when the trailing stop activates.

| Trailing Type | How It Works | Best For |

|---|---|---|

| None | No trailing stop. Stop stays fixed (or at break-even if configured). | Strategies with fixed targets that don't need trailing. |

| Ticks | Trails price by a fixed number of ticks. As price advances, the stop moves up (for longs) or down (for shorts) maintaining the tick distance. | Simple trailing for scalpers and short-term traders. |

| ATR | Trails by a multiple of ATR (configurable period and multiplier). Adapts to volatility in real time. | Professional trailing that respects market volatility. Wider trail in volatile periods, tighter in calm markets. |

| Chandelier Stop | Uses the Chandelier Stop indicator (EMA + ATR range multiple). Trails from the highest high using an ATR-based buffer. Configurable EMA length and range multiplier. | Trend-following traders who want to ride long moves. The Chandelier Stop is designed to stay out of normal volatility while catching genuine reversals. |

| Parabolic SAR | Uses the Parabolic SAR indicator with configurable acceleration, acceleration max, and acceleration step. | Traders who want a trailing stop that accelerates as the trend extends. Starts slow and tightens progressively. |

| Previous Bar High/Low | Trails to the previous bar's high (shorts) or low (longs) on each new bar. | Simple structure-based trailing that always respects the most recent price action. |

Trailing Stop Trigger

The trailing stop doesn't have to activate immediately. Configure a trigger that determines when the trail begins:

- ATR-based trigger: The trailing stop activates once price moves a configurable ATR distance in your favor. This prevents the trail from engaging on small moves.

- When Break-Even: The trailing stop activates after the position has been moved to break-even. First secure the risk-free position, then let the trail work.

An additional offset in ticks can be added to the trigger price for fine-tuning.

11. Scalp + Runner System

The Auto Trader supports a dual-position system that splits every trade into two parts: a scalp and a runner. This lets you capture quick profits on part of your position while letting the rest ride for larger gains.

Scalp Position

The scalp is designed for quick profit capture. It uses a tight target and may have its own break-even and trailing stop settings. The scalp portion of the trade exits first, locking in guaranteed profit.

- Its own position sizing (contracts, dollars, or percentage)

- Its own target type and distance

- Its own break-even trigger

- Its own trailing stop (optional)

Runner Position

The runner is designed for extended profit capture. It uses a wider target (or no target) and relies on trailing stops to maximize gains on strong moves. Enable the runner by toggling Enable Runner in settings.

- Its own position sizing (independent from scalp)

- Its own target type — or None for trend following

- Its own break-even trigger

- Its own trailing stop type and trigger

- Max contracts limit

12. Risk Management Filters

Protect your account with comprehensive risk management filters that automatically stop trading when limits are reached. These are your safety nets — they prevent overtrading, revenge trading, and catastrophic drawdowns.

Daily Profit & Loss Limits

Daily Profit Filter: When your daily profit reaches a configurable dollar amount, the strategy stops trading for the day. Locks in profits and prevents giving back gains on continued trading.

Daily Loss Filter: When your daily loss reaches a configurable dollar amount, all trading stops. Your most important risk management tool — prevents catastrophic days.

Daily Drawdown Filter

Tracks your intraday peak-to-trough drawdown. If your equity drops a configurable amount from its daily high, the strategy stops. This catches scenarios where you were profitable, gave it all back, and are now losing — a sign that the market isn't cooperating with your approach today.

Session Filter

Restrict trading to a specific time window. Set a start time and end time — the strategy only takes trades within this window. Perfect for focusing on the most liquid hours (e.g., US open 9:30-11:00 or European overlap).

Day of Week Filter

Enable or disable trading on specific days. Some instruments behave differently on certain days (Mondays tend to be ranging, Fridays have early exits). Turn off days that don't suit your strategy.

Volume & Delta Filters

Add minimum thresholds for volume and delta before the strategy can enter a trade:

- Volume Filter: Minimum total volume required on the bar. Prevents trading on low-activity bars that produce unreliable signals.

- Delta Filter: Minimum absolute delta required. Ensures there's enough directional conviction behind the signal.

- Delta Percentage Filter: Minimum delta as a percentage of total volume. Measures how "one-sided" the bar needs to be before qualifying for a trade.

13. Custom C# Signals

For traders who want maximum flexibility, the strategy provides 5 custom signal slots where you can write C# code that accesses 84 orderflow metrics directly. If the built-in signals don't cover your exact strategy, build it yourself with full programmatic access to the orderflow data.

Available Metrics

Your custom code has access to all of these bar-level properties:

Volume & Delta Metrics

Volume— Total bar volumeDelta— Net delta (ask - bid)MinDelta/MaxDelta— Intra-bar delta extremesDeltaRate— Speed of delta change (configurable: Tick mode measures delta per tick, Millisecond mode measures delta per time unit)DeltaChange— Delta vs. previous barDeltaChangePercentageDeltaPercentage— Delta / Volume ratioVolumePerSecond— Volume rateCumulativeDelta/CumulativeVolumeTotalAsks/TotalBidsTrades— Number of tradesRatio— Ask/Bid ratioCOTHigh/COTLow— Close of Trade high/low

Price & Structure Metrics

Open,Close,High,LowPOC— Point of Control priceValueAreaHigh/ValueAreaLowIsGreenBar/IsRedBarOpenAndCloseAbovePOCOpenAndCloseBelowPOCDeltaRise,DeltaFlip,DeltaTailDeltaReversal,DeltaDrop,DeltaSweepCloseAtMinMaxDelta- All imbalance counts:

BuyImbalances,SellImbalances,StackedBuyImbalances,OversizedBuyImbalances,BigBuyImbalances, etc.

Signal variable to 1 (long), -1 (short), or 0 (no signal). You have full access to CurrentBar, the bar data collections, and an expression evaluator for dynamic calculations. Custom signals show up in the signal designer and bar markers alongside all built-in signals.14. Bar Markers & Stripes

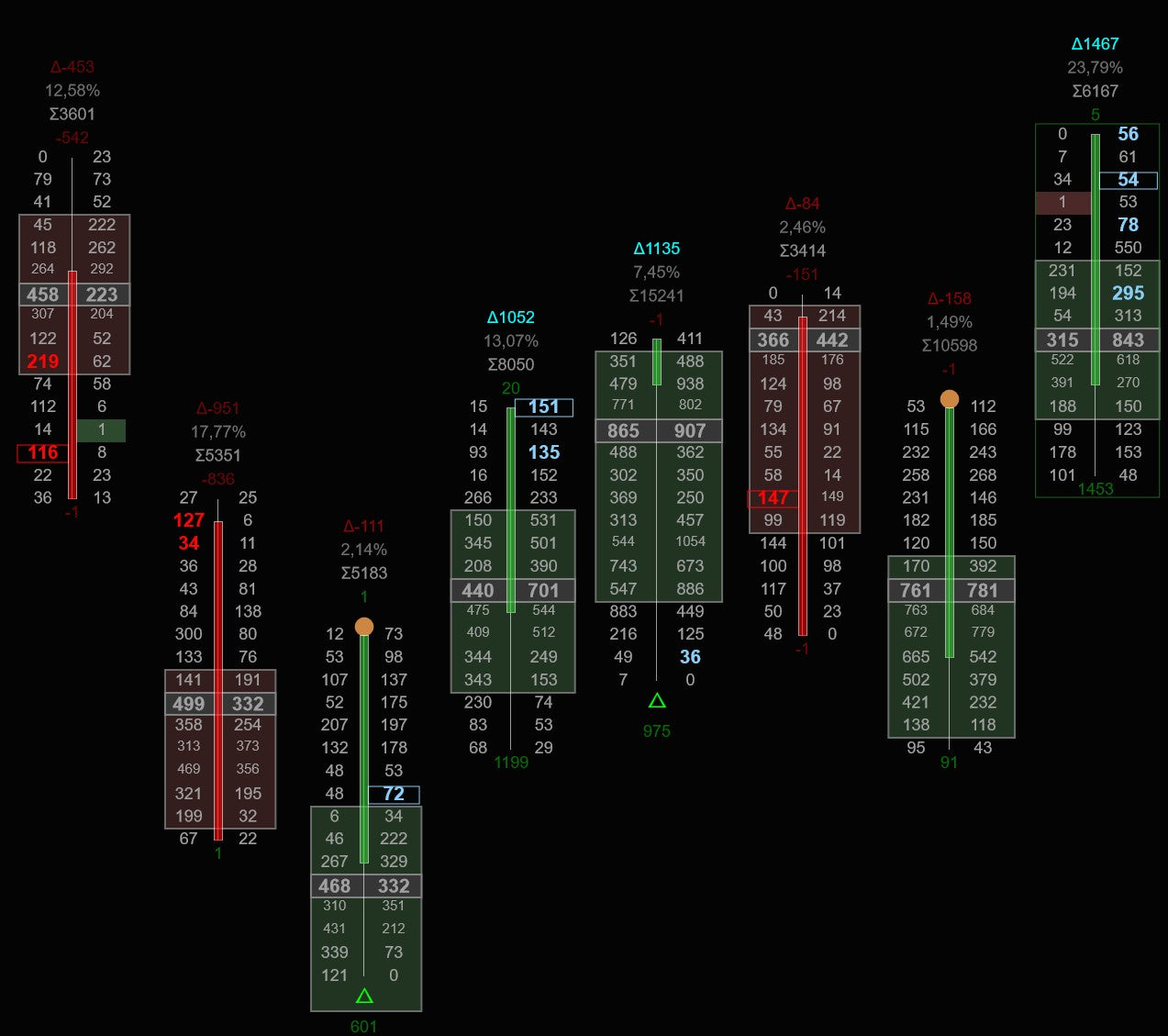

Visualize your signals directly on the chart. Bar markers display signal icons above/below bars when they fire, and stripes color the entire bar background to highlight specific conditions. Both help you visually verify what the strategy is seeing before and during live trading.

Bar Markers

Every built-in signal can display as a customizable marker symbol on the chart. Enable/disable each individually:

Bullish markers appear below bars in a configurable buy color. Bearish markers appear above bars in a configurable sell color. Each signal has its own customizable symbol character.

Stripes (Bar Coloring)

Stripes paint a colored overlay across the entire bar when a specific condition is met. You get 10 stripe slots, each assignable to any of the 44 alert types — including all the built-in signals plus 5 custom expression-based conditions.

Custom stripe expressions let you write C# code that dynamically sets the bar color and opacity based on any metric:

if (Ratio >= 30 || (Ratio > 0 && Ratio <= 0.7))

{

Opacity = 30;

BackgroundColor = "Cyan";

}

15. Control Panel

The Auto Trader includes a dockable control panel that gives you quick access to all essential controls without digging through settings. Dock it in the NinjaTrader Chart Trader panel for a compact view, or open it as a separate panel with a resizable layout.

Quick Actions

- Pause / Run — Toggle strategy on/off instantly

- Close All — Flatten all open positions with one click

- Break Even — Move all open trades to break-even instantly

- Refresh — Force recalculation of all signals

Signal Templates

Load any of your 16 saved templates with one click. Switch from a delta divergence strategy to a trapped traders strategy in seconds. Create new templates or save the current configuration.

Trade Controls

- Long/Short toggle — Disable longs or shorts on the fly

- Signal status — See which signals are currently active

- Equity display — Monitor strategy performance

- Stats view — Quick performance statistics

Start Trading Smarter Today

Try the Auto Orderflow Footprint Trader free for 7 days — full access to every feature, every signal, every setting.

No credit card required. Cancel anytime.

Start Your Free TrialMonthly Subscription

$69/month

Full access to all features. Cancel anytime. Includes all updates and new signals.

Lifetime License

$775 one-time

Pay once, use forever. All future updates included. Best value for committed traders.

Customers also look at

The following products are often combined with the orderflow auto trader

Join us on discord

Want to chat with us and other traders? Got questions on our indicators ? Or want to know more about our products?